Best SIP Funds Online

HOW HAS DSP BlackRock Small & Mid Cap Fund PERFORMED?

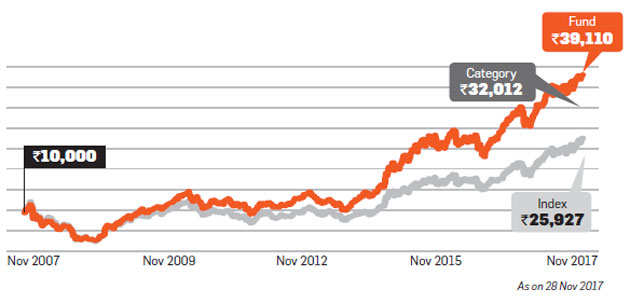

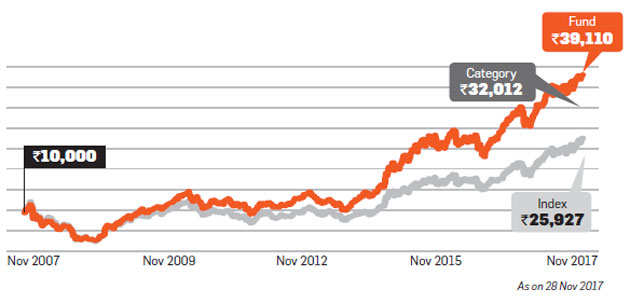

With a 10-year return of 14.61%, the fund has outperformed both the category average (12.34%) and the benchmark (10%) by a good margin.

With a 10-year return of 14.61%, the fund has outperformed both the category average (12.34%) and the benchmark (10%) by a good margin.

Should you invest in DSP BlackRock Small & Mid Cap Fund?

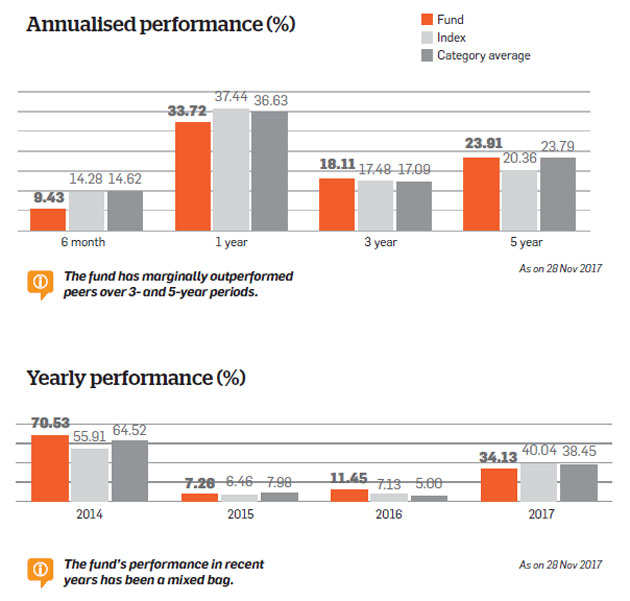

This fund invests predominantly in mid-cap stocks but takes a sizeable exposure in small-caps as well. The focus is on nascent companies with high growth potential. The fund manager places emphasis on quality and avoids inferior businesses even if these look tempting from a valuation perspective.

This fund invests predominantly in mid-cap stocks but takes a sizeable exposure in small-caps as well. The focus is on nascent companies with high growth potential. The fund manager places emphasis on quality and avoids inferior businesses even if these look tempting from a valuation perspective.

Over the past year, the fund portfolio has grown, having added to some of the underperforming sectors like chemicals and healthcare. Its portfolio churn has come down significantly. The heavily diversified portfolio is run completely agnostic of its benchmark index— most bets are from outside the index—which can at times lead to bouts of underperformance as seen in the recent years.

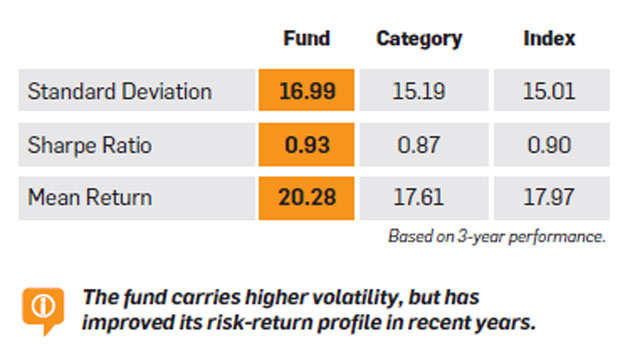

DSP BlackRock Small & Mid Cap Fund return profile has dipped slightly but the discipline exhibited by the fund manager should yield results over the long term.

SIPs are when Stock Market is high volatile. Invest in Best Mutual Fund SIPs and get good returns over a period of time. Know Top SIP Funds to Invest Save Tax Get Rich

For further information on Top SIP Mutual Funds contact Save Tax Get Rich on 94 8300 8300

OR

You can write to us at

Invest [at] SaveTaxGetRich [dot] Com

No comments:

Post a Comment